Download the LECA and RUREGOLD solution guide to accessing the tax incentives offered by SismaBonus 110% and EcoBonus 110%

The 110% SUPERBONUS SOLUTION GUIDE offers numerous solutions for masonry and concrete buildings, including structural and anti-seismic strengthening and thermal insulation, providing full access to the 110% tax incentives.

SUPERBONUS 110%

What is it?

Under the Italian Government’s Relaunch Decree, the tax deduction rate for expenses incurred when carrying out anti-seismic and energy conservation work on homes and buildings between 1 July 2020 to 31 December 2021 was raised to 110%, in addition to the deductions on other types of work carried out on existing buildings (renovation and facade bonuses).

Tax Incentives

An innovative aspect of this initiative was the possibility of benefiting from tax deductions, equivalent to 110% of the expenses incurred, including project and approval costs, either via:

-

direct tax deduction, to be divided into 5 equal annual instalments, subject to the claimant’s annual tax liability, deriving from the tax return;

-

discount on the invoice, advance contribution from the supplier of the goods or services;

-

transfer of tax credits, advance contribution referring to the deduction due in favour of: – suppliers of the goods and services necessary to carry out the work; other subjects (individuals, companies or other bodies); credit institutions and financial intermediaries.

SISMABONUS 110%

The Sismabonus 110% (valid from 1 July 2020) represents an upgrade of the Sismabonus 2017 which, eliminated the need to improve the seismic class while inserting more stringent technical and fiscal checks, raises any deductions related to static structural works (previously 50%) and anti-seismic improvement to 110%.

ECOBONUS 110%

The Ecobonus 110% introduces new incentives aimed at the energy redevelopment of the existing building stock through two specific types of procedures, defined as "driving", while also extending the 110% rate to other types of procedures defined as "driven" (already incentivised under the previous iterations of the Ecobonus) in compliance with the limits applicable to each type of real estate unit.

LECA AND RUREGOLD SOLUTIONS FOR SISMABONUS 110% AND ECOBONUS 110%:

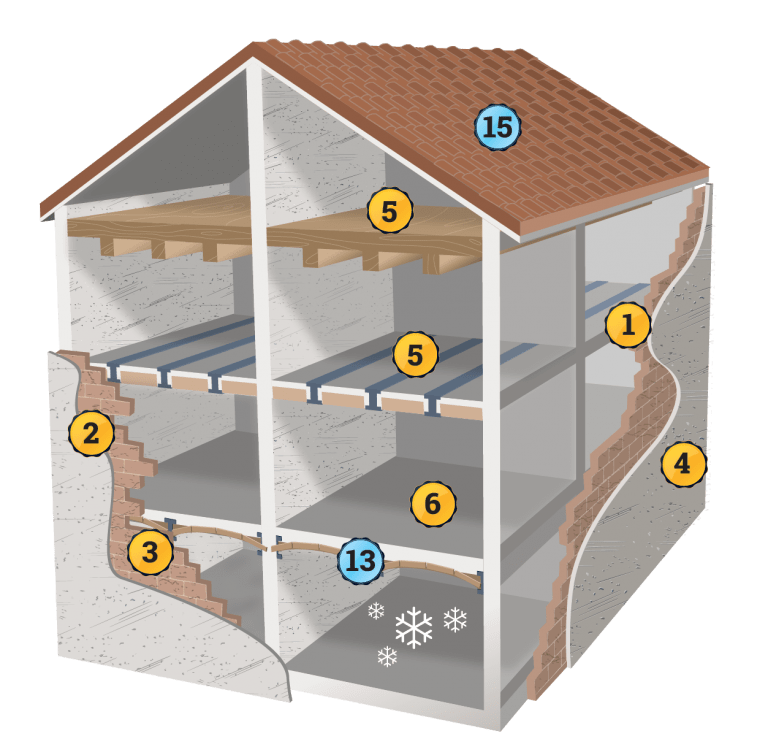

MASONRY STRUCTURES

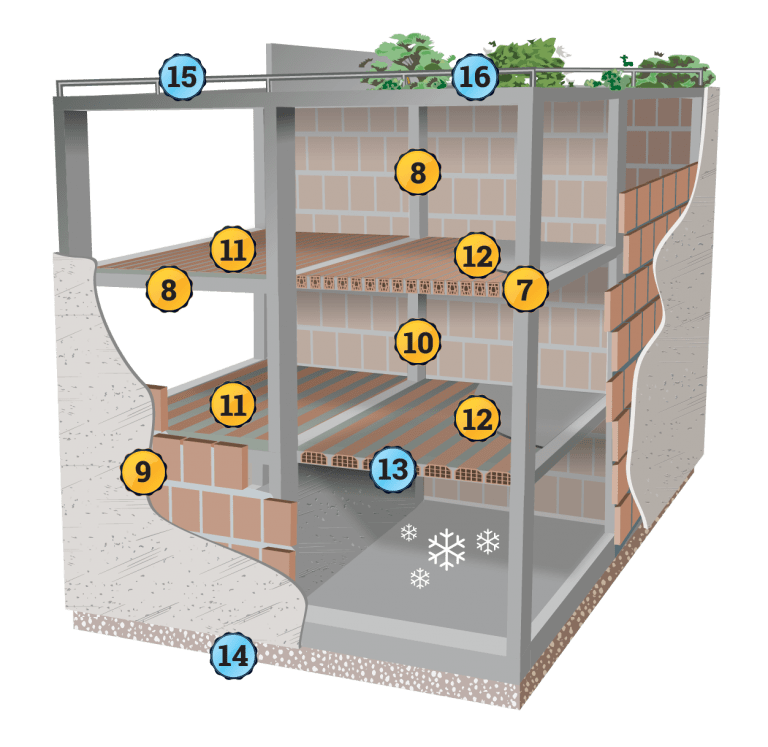

CONCRETE STRUCTURES

- Strengthening by bracing the outer building envelope FRCM system

- Structural strengthening of the external walls FRCM system

- Masonry repair work

- Structural strengthening of the building envelope| CRM system

- Static and anti-seismic strengthening of wood and steel slabs | Perimetro Forte System

- Static and anti-seismic strengthening of vaults FRCM System and Perimetro Forte

- Strengthening external structural nodes | FRCM system

- Strengthening columns and beams | FRCM system

9. Securing external infill walls FRCM system

10. Jacketing columns and beams | FRCM system

11. Static strengthening of concrete beam and block and SAP slabs

12. Low-thickness static strengthening of slabs FRC system

13. Thermal insulation of floor base screeds

14. Thermal insulation of slabs on grade

15. Thermal insulation of flat and sloping roofs

16. Thermal insulation of green roofs